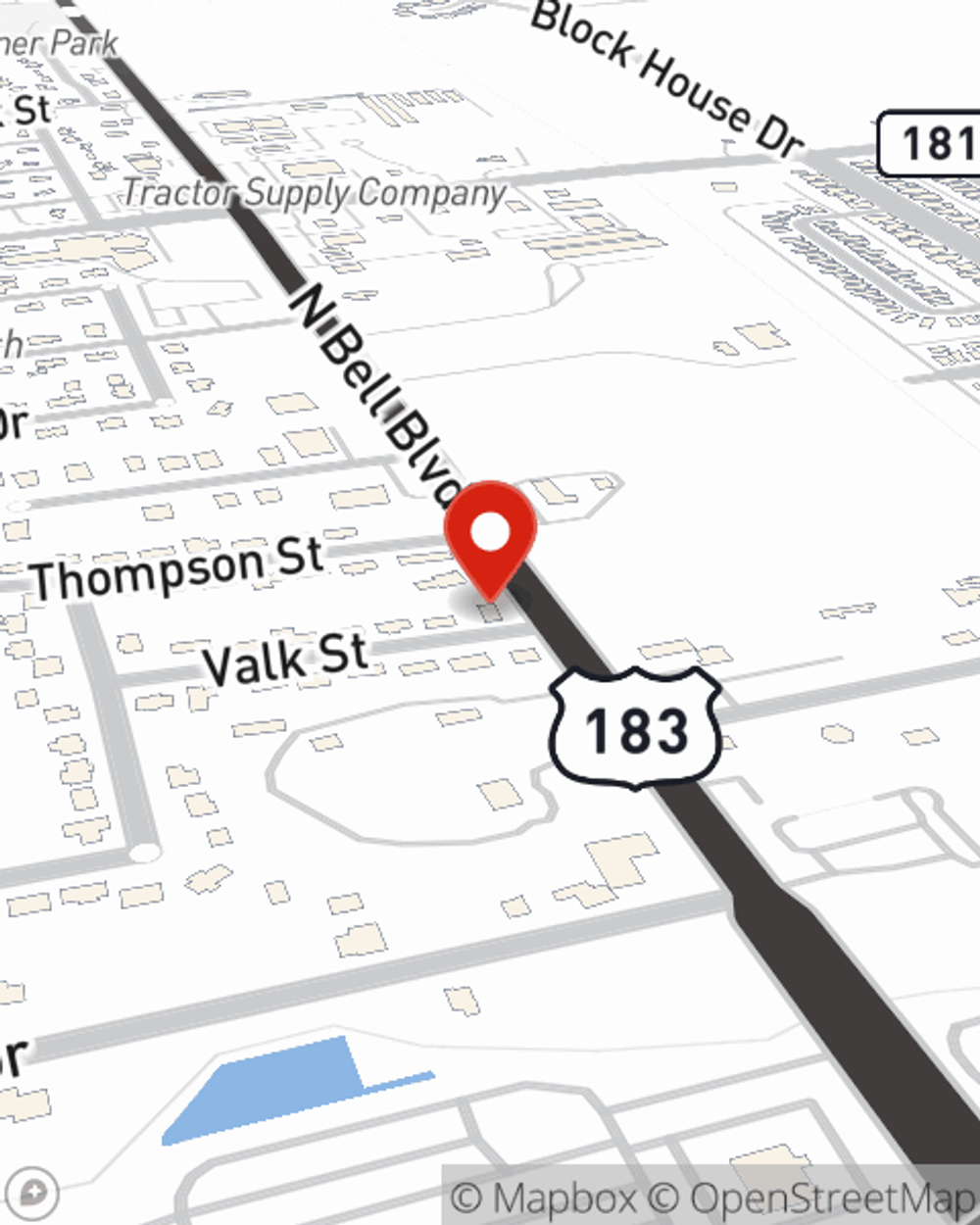

Renters Insurance in and around Cedar Park

Cedar Park renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Cedar Park

- Leander

- Liberty Hill

- Georgetown

- Austin

- Sun City

- Killeen

- Temple

- Marble Falls

- Bertram

- Burnet

- Lago Vista

- Jonestown

- Florence

- Harker Heights

- Pflugerville

- Hutto

- Taylor

- Elgin

- Manor

- Del Valle

- Dripping Springs

- Buda

Protecting What You Own In Your Rental Home

You have plenty of options when it comes to choosing a renters insurance provider in Cedar Park. Sorting through deductibles and savings options to pick the right one is a lot to deal with. But if you want cost-effective renters insurance, choose State Farm for covering all of your belongings and personal items. Your friends and neighbors enjoy remarkable value and no-nonsense service by working with State Farm Agent Craig Carnesi. That’s because Craig Carnesi can walk you through the whole insurance process, step by step, to help ensure you have coverage for everything you own inside your rental, including sports equipment, appliances, furnishings, linens, and more! Renters coverage like this is what sets State Farm apart from the rest. Agent Craig Carnesi can be there to help whenever trouble knocks on your door, to help you submit your claim. State Farm provides you with insurance protection and is here to help!

Cedar Park renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Agent Craig Carnesi, At Your Service

Renters insurance may seem like the last thing on your mind, and you're wondering if it's really necessary. But imagine what would happen if you had to replace all the valuables in your rented townhome. State Farm's Renters insurance can help when thefts or accidents damage your belongings.

As a commited provider of renters insurance in Cedar Park, TX, State Farm strives to keep your belongings protected. Call State Farm agent Craig Carnesi today for help with all your renters insurance needs.

Have More Questions About Renters Insurance?

Call Craig at (512) 259-2535 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Craig Carnesi

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.